Decoupling payment acceptance from payment verification.

FUGU offers a new breed of payment fraud and chargeback liability solution tracking payments post-checkout, helping merchants safely accept transactions they currently lose to fraud, false declines, and payment churn.

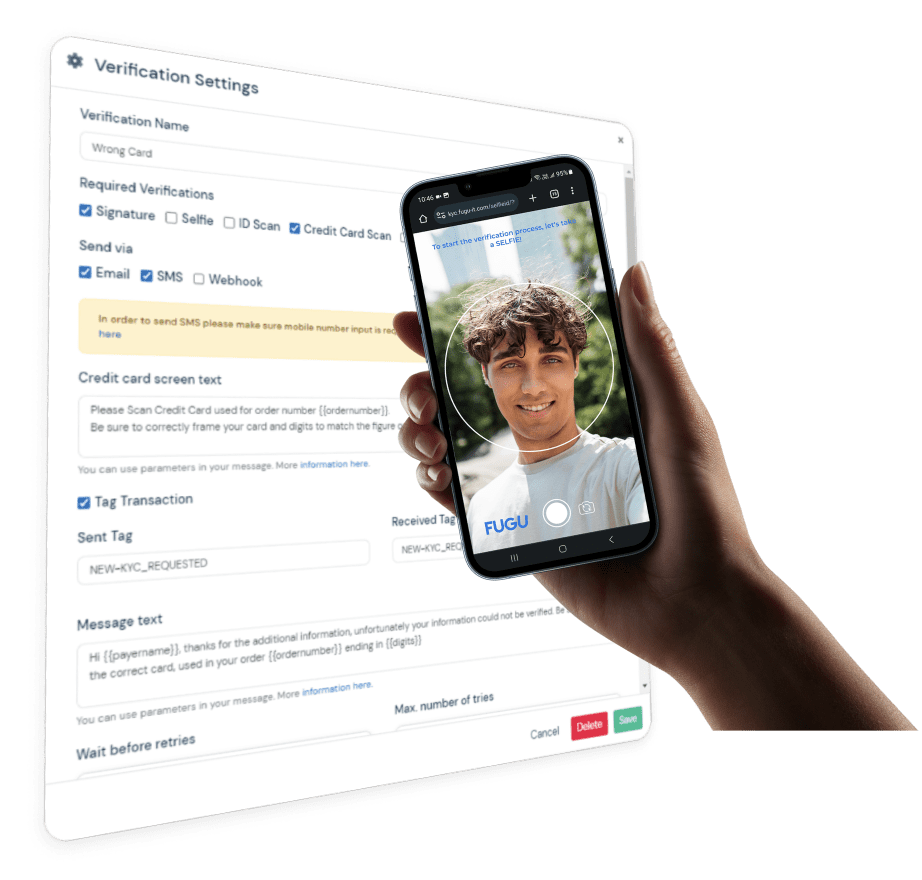

Our award-winning multi-tier fraud prevention solution, decouples payment acceptance and payment verification by fighting fraud at various points along the transaction life cycle covering a wide variety of risk patterns and payment models that are currently not attended by any other solution in the market.

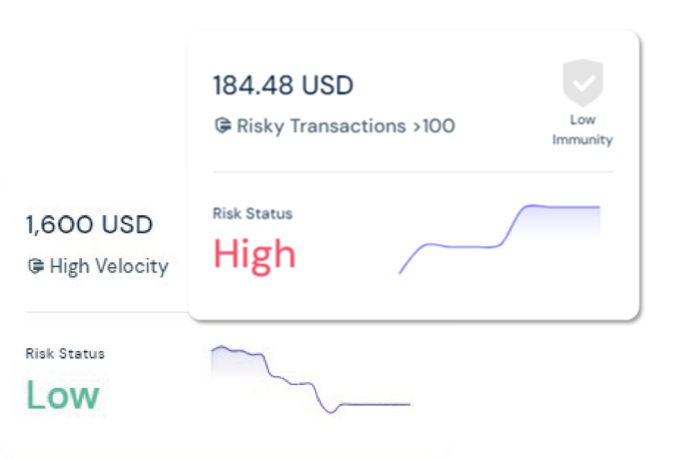

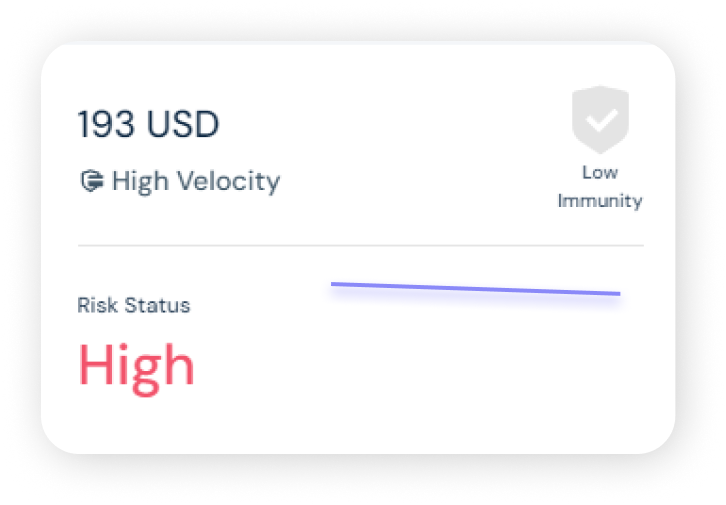

Risk Scoring

Assess

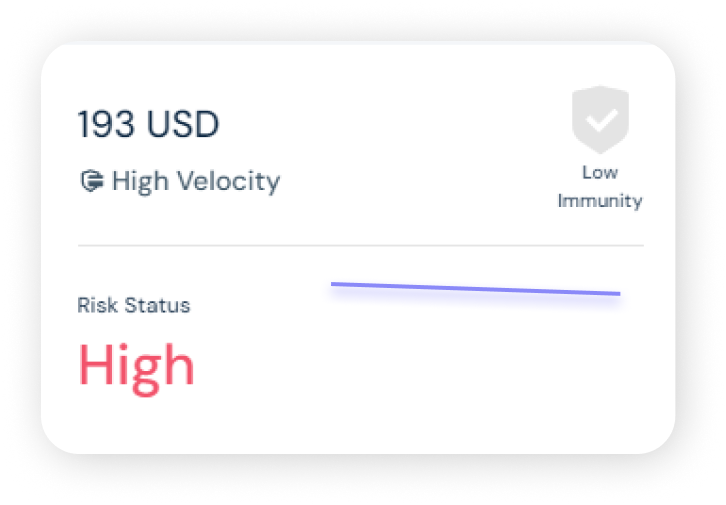

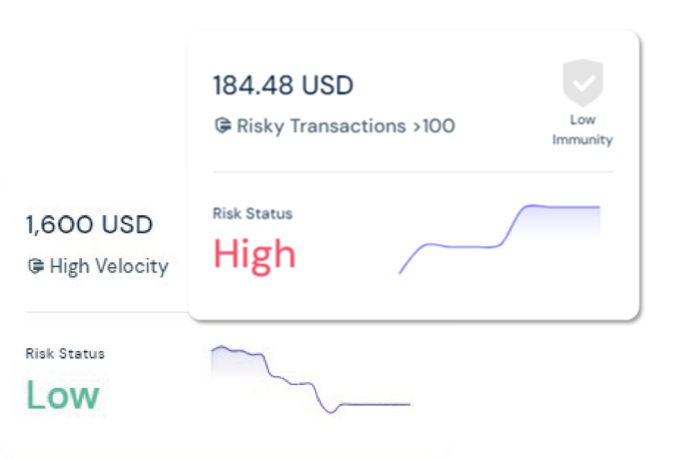

When an order is created an Initial Risk analysis is performed indicating the order’s potential for approval.

Monitor

As delivery process advances, FUGU activates sensors and verifications; signs of risk and evidence of value delivery are collected over time in order to make the most informed decisions before goods are shipped or digital goods are downloaded.

Classify

Based on the orders characteristics and initial Risk analysis the payment is classified for risk scenario.

This scenarios are highly customizable to meet the specific merchant risk profile and easily tuned to the business seasonal needs.

Reassess

Whenever a new signal is detected, FUGU reevaluates the risk and scores the transaction interaction trail for various unique behavioral factors such as stability, cooperation and sentiment.

51%

of friendly fraud blocked

42%

reduction in false declines

61%

of chargebacks recovered

74%

reduction in

labor cost

Chargeback Guarantee

Taking ownership of all your payment risk operations with the Highest approval rates, chargeback handling, and immediate reimbursement.

Highest approval rate in the market

FUGU’s unique multi-tier approach allows us to validate transactions until shipment, making sure no transaction is declined due to lack of information.

Automatic evidence collection

In case of a chargeback, we will fight it. No need for you to provide anything beyond proof of delivery.

Hybrid scoring and chargebacks liability tailored to each merchant’s needs

We let you decide what types of transactions you would like to guarantee & fight all chargebacks for you.

Immediate reimbursement

First we give you the money back, then, when we eventually win, we’ll adjust.

The first hybrid chargeback liability service highest approval rate guaranteed

as wardrobing & Return fraud without hurting their conversion rates.

Risk Management for PSP’s

FUGU offers Payment Service providers Gradual risk mitigation platform empowering PSP’s to decide which FUGU functionality will be used out of the box for their internal needs or as part of their standard offering. Advanced risk management capabilities can be sold by the payment provider to clients, lowering the PSP risk management cost

We are now Mastercard partners, an incentive program is now available for any adapters, contact us for further information

Onboarding

FUGU can start monitoring and automating your customers on boarding process from day one, facilitating:

– User verification

– Document collection & management

– Initial risk analysis

Decoupling payment acceptance and payment verification.

FUGU offers a new breed of payment fraud and chargeback liability solution tracking payments post-checkout, helping merchants safely accept transactions they currently lose to fraud, false declines, and payment churn.

Our award-winning multi-tier fraud prevention solution, decouples payment acceptance and payment verification by fighting fraud at various points along the transaction life cycle covering a wide variety of risk patterns and payment models that are currently not attended by any other solution in the market.

Risk Scoring

Assess

When an order is created an Initial Risk analysis is performed indicating the order’s potential for approval.

Monitor

As delivery process advances, FUGU activates sensors and verifications; signs of risk and evidence of value delivery are collected over time in order to make the most informed decisions before goods are shipped or digital goods are downloaded.

Classify

Based on the orders characteristics and initial Risk analysis the payment is classified for risk scenario.

This scenarios are highly customizable to meet the specific merchant risk profile and easily tuned temporal

Reassess

Whenever a new signal is detected, FUGU reevaluates the risk and scores the transaction interaction trail for various unique behavioral factors such as stability, cooperation and sentiment.

51%

of friendly fraud blocked

42%

reduction in false declines

61%

of chargebacks recovered

74%

reduction in labor cost

Chargeback Guarantee

Taking ownership of all your payment risk operations with the Highest approval rates, chargeback handling, and immediate reimbursement.

Highest approval rate in the market

FUGU’s unique multi-tier approach allows us to validate transactions until shipment, making sure no transaction is declined due to lack of information.

Automatic evidence collection

In case of a chargeback, we will fight it. No need for you to provide anything beyond proof of delivery.

Hybrid scoring & chargebacks liability tailored to each merchant needs

We let you decide what types of transactions you would like to guarantee & fight all chargebacks for you.

Immediate Reimbursement

First we give you the money back, then, when we eventually win, we’ll adjust.

The first hybrid chargeback liability service highest approval rate guaranteed

as wardrobing & Return fraud without hurting their conversion rates.

Risk Management For PSP’s

FUGU offers Payment Service providers Gradual risk mitigation platform empowering PSP’s to decide which FUGU functionality will be used out of the box for their internal needs or as part of their standard offering. Advanced risk management capabilities can be sold by the payment provider to clients, lowering the PSP risk management cost.

We are now Mastercard partners, an incentive program is now available for any adapters, contact us for further information

Onboarding

FUGU can start monitoring and automating your customers on boarding process from day one, facilitating:

– User verification

– Document collection & management

– Initial risk analysis