The Storm the Day After Black Friday

The digital commerce landscape is shifting again.

We’re moving from a world where humans initiate, verify, and complete transactions, to one where AI agents perform these actions autonomously on our behalf.

This is the beginning of the Agentic Commerce era — and it’s already here.

OpenAI and Stripe have made it tangible through the launch of Instant Checkout in ChatGPT and the Agentic Commerce Protocol (ACP).

Why PSPs lose merchants faster than fraudsters steal money

The digital commerce landscape is shifting again.

We’re moving from a world where humans initiate, verify, and complete transactions, to one where AI agents perform these actions autonomously on our behalf.

This is the beginning of the Agentic Commerce era — and it’s already here.

OpenAI and Stripe have made it tangible through the launch of Instant Checkout in ChatGPT and the Agentic Commerce Protocol (ACP).

Reading Between the Payments: Human Patterns Behind Fraud

The digital commerce landscape is shifting again.

We’re moving from a world where humans initiate, verify, and complete transactions, to one where AI agents perform these actions autonomously on our behalf.

This is the beginning of the Agentic Commerce era — and it’s already here.

OpenAI and Stripe have made it tangible through the launch of Instant Checkout in ChatGPT and the Agentic Commerce Protocol (ACP).

When Agents Make The Payments Behaviour Becomes Identity

The digital commerce landscape is shifting again.

We’re moving from a world where humans initiate, verify, and complete transactions, to one where AI agents perform these actions autonomously on our behalf.

This is the beginning of the Agentic Commerce era — and it’s already here.

OpenAI and Stripe have made it tangible through the launch of Instant Checkout in ChatGPT and the Agentic Commerce Protocol (ACP).

Are PSPs Caught Between a Rock and a Hard Place?

For PSPs, every transaction feels like walking a tightrope.

On one side, banks and acquirers demand near-zero fraud, stricter compliance, and flawless risk management. On the other, merchants want frictionless approvals, instant payments, and conversion rates that keep their business alive.

Security Without Friction: How Merchants Can Stop Fraud Without Losing Customers

Fraud prevention has always been a balancing act. Merchants want to protect revenue, but adding too much friction at checkout often means losing legitimate customers. In fact, false declines and abandoned carts can cost more than fraud itself. The challenge is clear: how do you secure transactions without sacrificing the customer experience?

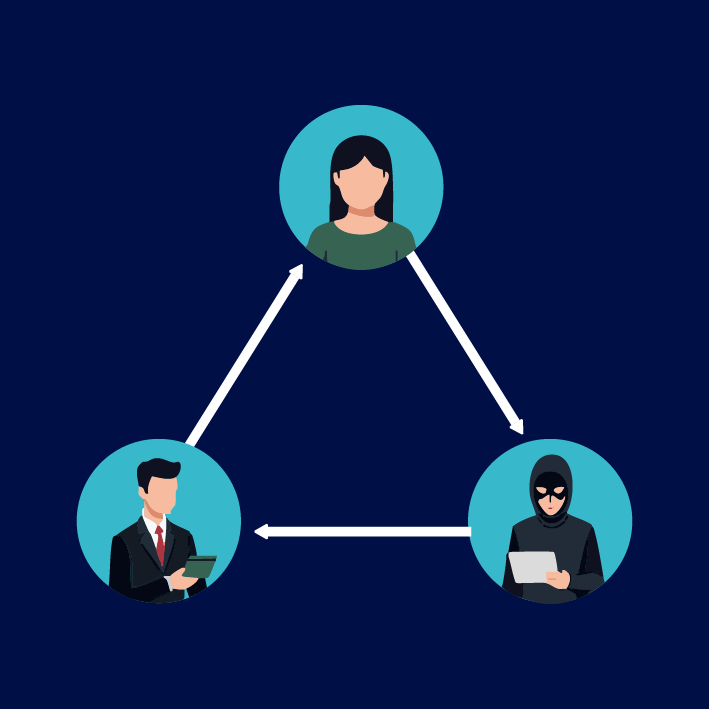

What is Triangulation Fraud? How to Defend Against Reseller Scams

Consider the perfect eCommerce sale. An honest customer buys a product online that the merchant fulfills. The merchant earns business revenue, while the customer receives a needed good or service. Everyone is happy.

Fighting Shopify False Declines With FUGU

Over the years, Shopify has earned its place at the top of the eCommerce food chain, with sellers in 175 countries in the world. Because of its popularity, fraudsters see businesses on Shopify as attractive targets.

Fighting Authorized Push Payment (APP) Fraud Post Payment

Payment scams are rampant. The Federal Trade Commission (FTC) shows that consumers filed a staggering 2.5 million fraud reports in 2023, amounting to more than $10 Billion in losses. Of those reports, 853935 were imposter scams, marking an increase from 2022. In addition, 80% of businesses reported attempts of fraud activity last year. Everyone is at risk.

Maximizing conversions with ecommmerce payment configuration

Finding the right way to maximise conversion while protecting your eCommerce store from fraud is crucial for growing your business.