E-commerce uncertainty leads to loss of valid business

The fundamental problem of e-commerce risk is uncertainty. There is only so much you can get to know about your customer, without severely damaging the funnel and conversion rates. As anyone who has a sales funnel knows, each added step between product and customer has a cost in conversion. At this very moment, many designers and engineers all over the world are struggling to minimize friction, to perfect their customer journey. All of these efforts come to a halt as the funnel reaches what used to be called the final destination, checkout and payment. At this point, the customer is handed over to a third party, the payment processor. These suppliers are providing a valuable service, but they are also shaping it to protect themselves by blocking or challenging the customer before payment is concluded. In most cases these practices cause a significant loss of valid business to the merchant.

Old trick: Buy time and gather more information before you decide

There are several ways of dealing with this uncertainty, some are happy enough with overprotection, the cost is usually hidden from them and when asked they will say they have no problem with chargebacks or fraud. Others aware of the loss will try to get to know the customer pre-payment, asking many questions and significantly raising churn rates since fraud absolutely does not account for all the churn. A third option is to delay the decision using all available time to reveal more information. This is what FUGU does, we use the time after the payment to gather more information. Our data from live customers is now robust enough to show that the time after the payment can be extremely valuable if used correctly. Monitoring post payment behavior against a variety of signals recorded by our sensors shows that fraud clearly separates itself from genuine payment complexities, a process rapidly accelerated by the proactive measures taken.

FUGU’s post-payment risk prediction safely validates more transactions

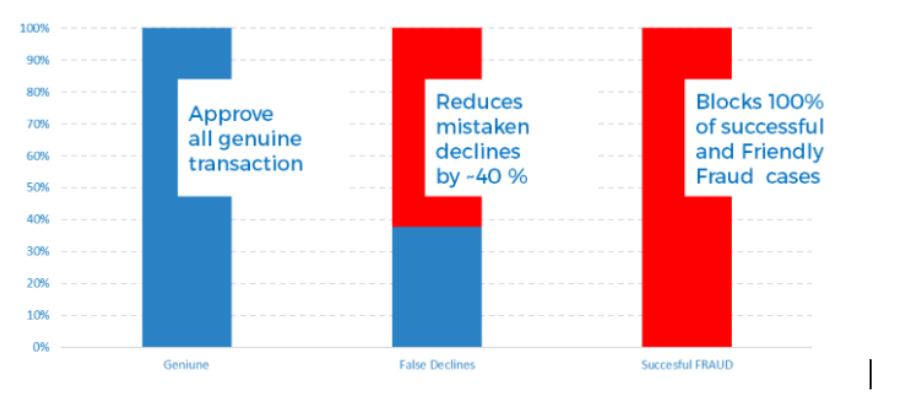

The data proves the validity of bringing back old tricks to a new data set. The bottom line is:

FUGU approves 40% of the transactions previously blocked by mistake.

Just that translates into a 1% increase in topline.

But there is more,

FUGU successfully identified 100% of Friendly Fraud for that specific time period.

Simply put, it is money on the table!